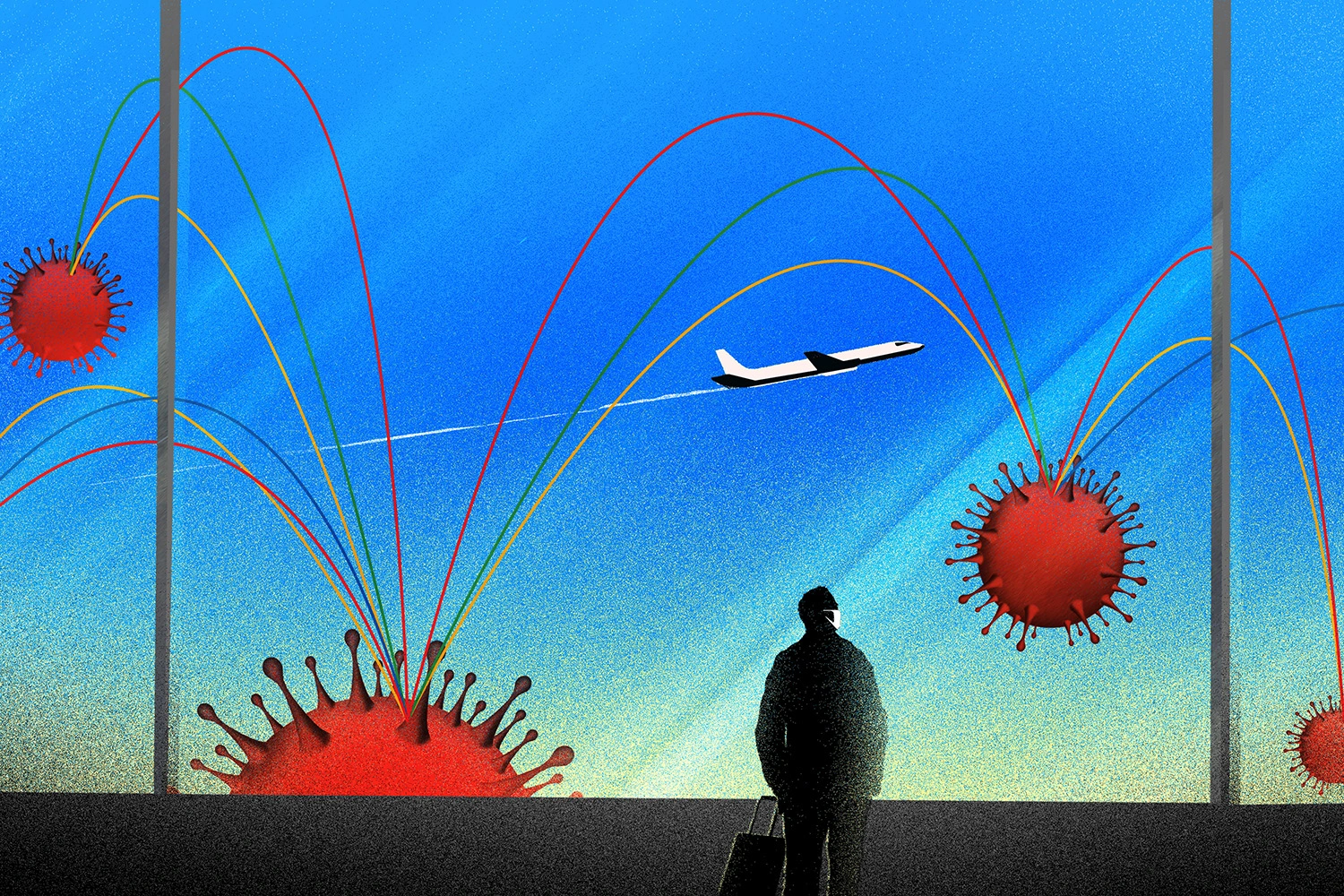

From border shutdowns to cancelled flights and cruises, the coronavirus pandemic has caused travel to grind to a halt. But what if you have to travel for an emergency? Or do you need to get back home?

What do you do about flights you’ve already booked but won’t be able to take? And when will it be time to leave your house and explore the world again? Share with others these tips for safe travel during pandemic and don’t miss out on your chance to get more views with Socialgreg.

Medical experts warn that now is not the time to take advantage of cheap airline flights. You shouldn’t put yourself or others at unnecessary risk. And before we get to how to recoup money from planned travel or how to think about travelling in the future, we strongly recommend readers follow the guidance by the Centres for Disease Control and Prevention (CDC).

Events are unfolding quickly. Recently, the government’s guidance was to rethink travel, but now, the State Department’s advice is to avoid all international travel (if you are stuck abroad, sign up for STEP to get notifications).

The CDC doesn’t offer specific advice for domestic travel–though the Trump administration hasn’t ruled out grounding all domestic flights and is encouraging people to limit gatherings to 10 people or less. But the agency does take potential travellers through a few key questions, including age, travel region, and health of travel companions. If you are thinking about non-essential travel, visit their website to learn more.

Emergency Travel

If you have to travel, follow the CDC’s guidelines on how to best protect yourself and others. These include washing your hands, avoiding close contact, and covering your mouth and nose with a tissue when you sneeze or cough.

And even if there is an emergency, there are a few places Americans can’t travel right now. Currently, the New York Times lists these as Canada, 26 countries in the European Union, Kenya, Argentina, El Salvador, Guatemala, Jordan, Saudi Arabia, Denmark, and Mexico.

A trip overseas could come with a hefty 14 day quarantine period–on both ends of the trip. While most major airlines are offering flexibility in changing dates (even for formerly restrictive fares), you’ll need to weigh whatever lost travel costs (airfare, hotels, etc.) against potential lost wages if you are quarantined for two weeks when you return.

Recouping Costs

For many travelers, flights and hotels make up the majority of their travel expenses. The airline and hotel industries are being hit hard by the global pandemic yet they are loosening otherwise rigid change fees. Below are the policies (as of March 17, 2020) for some of the major lodging companies, airlines, and cruises.

Lodging

Marriott Hotels announced they will allow cancellations up to 24 hours ahead of time until April 30, 2020.

IHG (Intercontinental, Kimpton, Crowne Plaza, Holiday Inn, is waiving all cancellation fees globally until April 30, 2020.

Radisson is allowing free modifications or cancelations on all stays until April 30, 2020.

Red Roof has also waived all cancellation fees for stays through April 30, 2020.

Airbnb is allowing travelers to cancel reservations in the U.S., Mainland China, South Korea, and Italy (as long as the reservation was made by March 13, 2020) for travel through April 1, 2020.

Flights

American Airlines is allowing travelers to rebook flights without change fees for trips until April 30, as long as the flight was booked before March 1, 2020. The airline has also cut back on flights, reducing international flights by 75% and cutting domestic seat capacity by 20% in April and 30% in May.

United Airlines is waving all change fees for customers travelling from Europe. For other flights booked before March 2, the airline is waiving all fees so long as travel is before April 30, 2020. And for flights you book by the end of March, United will waive change fees for the next 12 months. United is also cutting the number of flights it offers in April and May.

Delta is waiving change fees for all travel departing in March or April 2020 and asks customers to check back on their website to learn their decision about flights for May. The company is cutting 40% of its capacity.

Cruises

Carnival Cruises has halted service through April 9 on its North American fleet of ships. For travelers booked on a cruise before then, they can choose either to rebook (with additional credit) or a refund.

Royal Caribbean hopes to resume operations by April 11, 2020. For travel booked before then, they are offering customers 125% future credit to use before the end of 2021 or a refund.

Future Travel – Insurance

Health experts warn that we will need to hunker down for an extended period of time. Travel in April and May is likely to be affected and we’ll need to see what happens over the coming weeks and months to understand the risk.

While airlines and hotels have temporarily loosened their cancellation and rebooking policies, many travelers are finding themselves looking at trips outside of the cancellation window. For travel in May, there’s not yet guidance on what to do. This has lots of travelers reconsidering travel insurance.

Travel insurance can look expensive when booking a trip–it’s typically 5% to 10% of the total trip cost. Demand for travel insurance has spiked in the past month, but the U.S. Travel Insurance Association warns that most policies won’t cover events like the coronavirus. Allianz travel states, “Claims due to known, foreseeable, or expected events, epidemics, government prohibitions, warnings, or travel advisories or fear of travel are generally not covered…” but is providing emergency medical care and trip cancellation or trip interruption for customers that are ill with COVID-19.

Similarly, travel insurer Seven Corners states that “Our trip protection plans do not include a specific covered reason that will allow you to cancel your trip for fear of travel due to COVID-19.”

Cancel For Any Reason (CFAR) insurance is the most likely to cover it, though it’s unlikely travelers would get 100% of their money back. And many insurers are scaling back their offerings for CFAR, due to underwriters demands. CFAR coverage is additional to base travel insurance. It’s essential to read through any policy before purchasing to understand what it does and does not cover.

And insurers encourage travelers to buy insurance early. Many policies cover cancellations for illness or other issues (though you’ll want to read the fine print to understand what that entails), but it won’t kick in if you buy it after the event.

When you book your next trip, look into the different insurance options. Some of the major companies include Allianz Travel, Seven Corners, and medical travel insurers Medjet and International SOS.

Credit Card Assistance

Many credit cards offer travel insurance, from baggage coverage, travel accidents, delays, rental car coverage, and trip cancellations.

Travel credit cards often provide some type of insurance. For a card with no annual fee, the Capital One VentureOne Rewards card provides travel accident insurance along with other travel perks, such as earning 1.25 miles per every dollar and no transaction fees.

For a $95 annual fee, Chase Sapphire Preferred Card offers trip cancellation insurance, car rental collision, and other helpful perks such as no foreign transaction fees.

Eventually, We’ll Be Back on the Road

The U.S. travel and tourism industry is forecasted to lose at least $25 billion in foreign spending.

While travel seems like a terrible idea at the moment, eventually the medical professionals, scientists, and governments working on the front line of this pandemic will get the situation under control. And when they do, the travel industry will need our support.