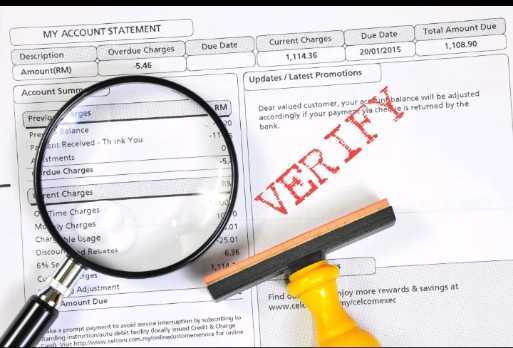

The spike in document fraud is stressing out digital businesses. It’s quite challenging to detect such activities. Thus document verification is the best solution to prevent fraud.

All types of businesses as well as social media platforms are becoming the victims of fraudsters. In order to prevent such suspicious activities and to reduce the risks, digital companies are obliged to identify the customers’ real identities before getting them on board. While incorporating the regulatory measures, digital businesses are facing various problems such as fewer resources, protecting customer experience, user information security, etc.

Keeping in view the situation, identity document verification is considered a perfect solution to overcome challenges. This allows online businesses to employ regulatory obligations and also provides a flawless customer onboarding process with improved data security measures.

Significance of Technology-based Document Verification

The rising number of financial scams is impacting digital businesses adversely. Hence, financial regulatory bodies like FATF, etc, have developed KYC/AML standards that aim to protect the businesses’ interests while deterring the source of fraud. Undergoing these compliances, the businesses have to comply with the customer due diligence process in their pre-existing systems. The basic need of this procedure is to assess and validate the users and also to verify their ID documents.

Primarily, know your customer process was done in all the financial corporations manually which was providing enough space for the fraudster to run their suspicious activities. However, due to technological advancements, using artificial intelligence and machine learning techniques the old school method to perform KYC is now completely automated providing precise verification results.

Digital document verification- providing ways to fight identity fraud

Most of us have sometimes undergone the moment either by registering over the social media platform or to open an account in the banks, where the clients are asked to provide government-issued ID documents such as driving licenses, identity cards, and passports. Primarily, the verification documents were done by the human officer which tends to verify the facial imprints of the customers with the images placed into the identity documents in order to get sure that bad actors are not tricking the verification officer.

These days with technological evolution, AI has taken over the role of verification officer but is in an improved manner. Artificial intelligence technology allows document verification systems to identify the real identities of their customers remotely. Additionally, it also authenticates the user transaction.

Spotlighting into the other side of the technology advancements fraudsters are becoming pro in their activities by using sophisticated tech tools and methods. The criminals have found innovative ways of developing fake documents that can fool traditional verification procedures.

Therefore, online document authentication is well equipped to detect such types of forged documents.

Types of Illegal Documents

Illegal documents

These types of identity documents are totally fake documents, in which the key features of the government-issued documents for example rainbow prints, holograms, templates, and other minor characteristics are not correctly placed as in the original ID documents.

Fake documents

Such documents are neither false nor photoshopped but they are original documents that are stolen or bought from the people. These documents are used by criminals in order to manipulate the verification systems.

Modified documents

The imposters alter the abducted original ID documents in a way that can not be identified through the human eye. The fraudster makes fewer changes in the victims’ information like name, date of birth, or other identifiable data to bypass the system. Benefits of Using technology-based Document Verification

Deterring Document Frauds

Almost all online businesses are prone to cyber fraud. Criminal activists are mostly indulged to commit crimes like identity fraud, making fake identity documents, and various other online crimes. Therefore, an online document verification solution eliminates the threat of becoming victim criminals. Once the customers upload the ID documents, OCR technology embedded into the verification system extracts the information and gets it authenticated. signs of tempering the documents are detected in this stage and the criminals are filtered out before any harmful activities are committed.

Enhance Cybersecurity

Digital businesses are adopting document checks to uplift their security measures. Document authentication solutions are significant for companies that want to identify the ID documents of their customers remotely instantly without any delays with the help of the identity document verification Process. In addition, the suspicious activities are precisely determined and the threat of becoming prone to fraudsters is diminished.

Ultimate Business Interests Protection

Online businesses by adopting online document verification services can secure the B2B interest. By determining the suspicious activities and eliminating them the businesses can save their brand name as well as their credibility.

Final Thoughts

Wrapping it up, client identity verification and ID document validation solutions are viable for digital businesses. As online companies are rapidly growing, the spike in the number of identity scams and ID document fraud is creating difficulties for businesses to sustain in this fast-moving world. Thus, its mandatory for digital businesses to comply with identity document verification solutions as advised by the regulatory authorities

click here for more interesting articles